Eager to dive into the world of financial analysis and gain invaluable hands-on experience? Look no further than the CFA Institute Research Challenge! This prestigious annual competition is your gateway to a realm of opportunity. Offering tertiary students’ mentorship and immersive training in financial analysis. The challenge is your chance to sharpen your skills alongside industry experts. Participants will work in teams to craft a comprehensive research report and deliver compelling recommendations. Read to find out more!

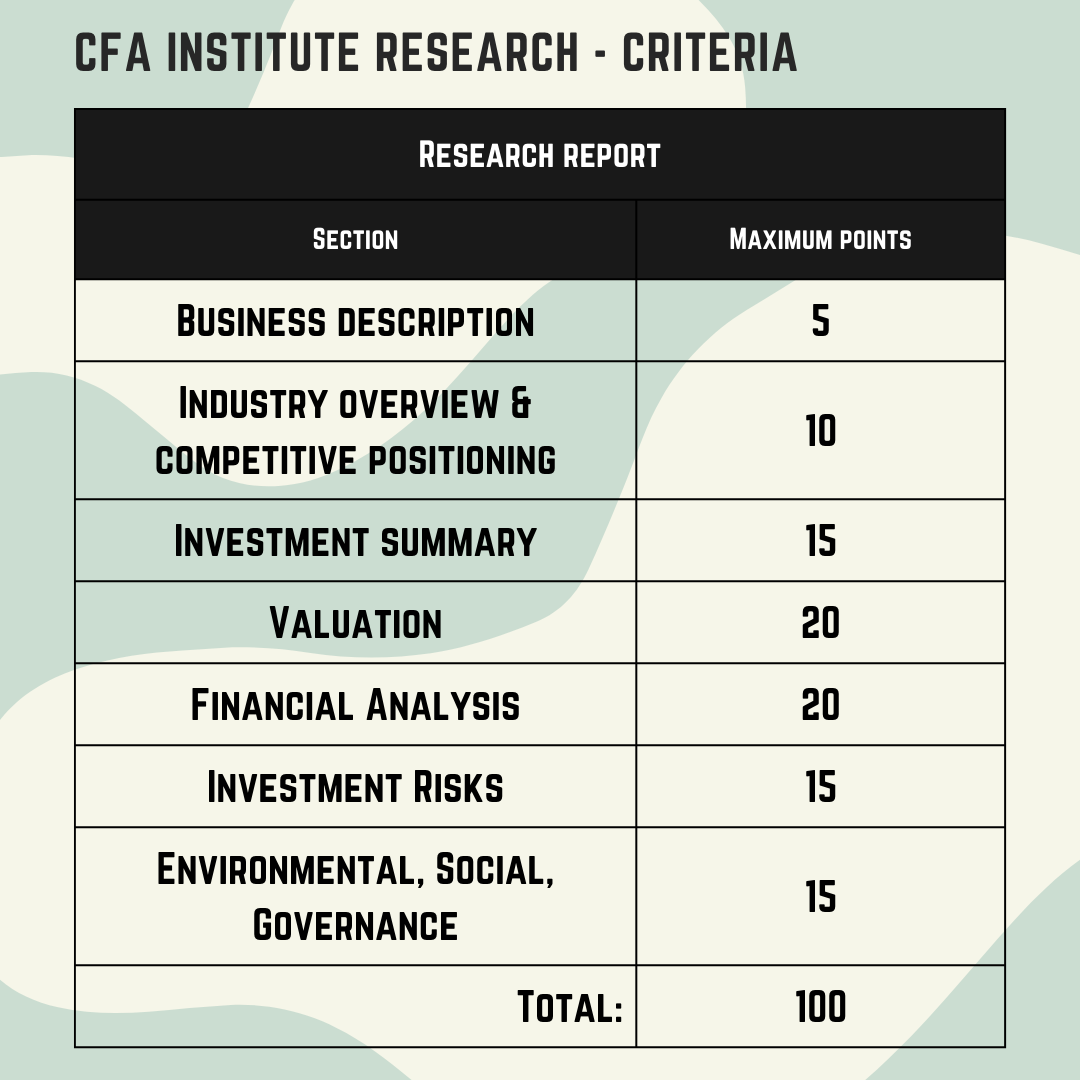

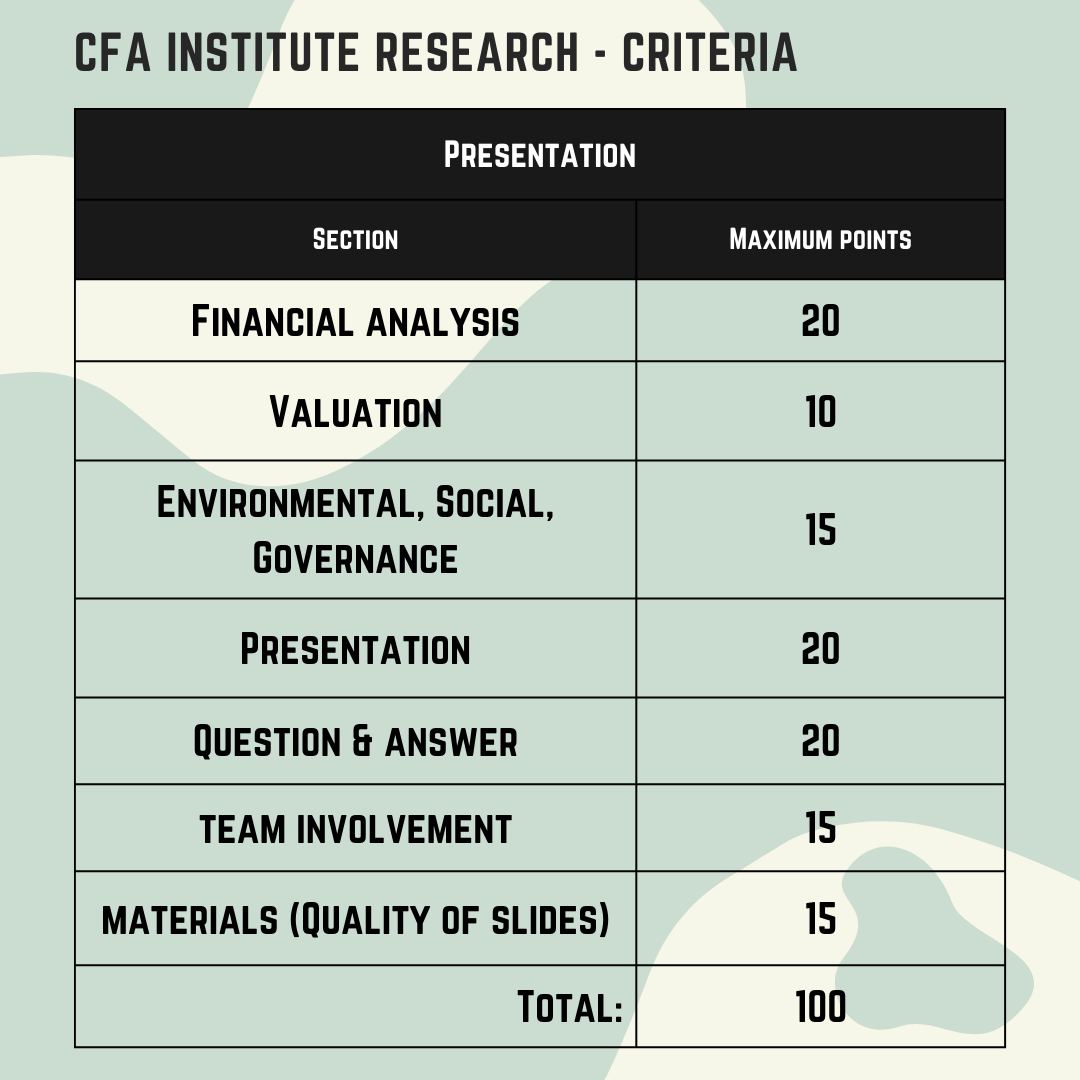

Teams will conduct research and analyze a designated publicly traded company; prepare a written report on that company that supports a buy, sell or hold recommendation; receive advice and support from a faculty advisor and industry mentor; and present and defend their findings to a panel of industry experts within 10 minutes. Winners from local competitions advance to subregional competitions, then on to regional competitions other parts of the world, ultimately until the global final.

The competition emphasizes and upholds impartiality and fairness. To mitigate any potential biases from judges, participants are identified by their team names rather than the institutions they represent.

Following intense preparation and countless hours of dedication, we had the privilege of interviewing Team Blue Capital, who competed in the local finals held on 3rd February 2024. The team consists of Lin Wei Jie (Team Leader), Hah Min Da, Chang Qi Qian and Hendrick Kwok En Rong.

What made you join this competition?

Wei Jie: The top reason for joining this competition is to gain exposure. These experiences include creating financial equity research report and gaining hands on experience on stockage. Additionally, this can contribute to our personal and research portfolios, shaping our future endeavors.

Hendrik: Overall, it’s a good learning experience and I love trying things out!

Qi Qian: By comparing your work with your competitors, you can gain insights about your work. This allows us for a comprehensive evaluation. going beyond self-analysis. While you may consider your work as your best, true assessment comes from observing how others present their data and the level of detail in their reports. This approach makes it easier to visualize and pinpoint areas of excellence, as well as identify areas for improvement.

Min Da: Last year, I didn’t have the opportunity to gain national exposure. This year, the team reached out to me to join, and I eagerly seized the chance. I wanted to broaden my experience beyond inter-school competitions.

How did you pick your teammates?

Qi Qian: We were all members of the same clubs, the SIM Investment and Networking Club, where we shared a common interest in finance. Three of us had previously collaborated in another case competition, gained valuable experience in working together. Recognizing the importance of chemistry within a team, especially in this competition, we aim to ensure effective collaboration, with each member contributing their part.

Wei Jie: I would advise anyone reading this article to carefully choose group members who align with your expectations and commitment level. Given the extended duration of this competition, people usually delay and drag time their time, they may –

Min Da: They may want to give up halfway.

Qi Qian: Delay or sweep assignments under the rug. It’s important to stick to the timeline!

Hendrik: Slowly, they might find it difficult to commit (to their tasks).

Wei Jie: Agree! They don’t tend to focus well. Finding people of the same interest and same drive as you to participate in the competition is pretty crucial.

Hendrik: While intelligence is valuable, the significance of hard work tends to be overlooked. The effort required in the background, both in producing the report and the speech, plays a major role in this competition.

Wei Jie: No matter what you do, creating report and slides takes time. Start early to ensure a well-prepared work submission for the judges.

Briefly describe why the team has chosen to analyze Sembcorp over Singapore airlines (SIA)

Qi Qian: Personally, for us, we all recognized that the understanding the business model of Sembcorp posed a greater challenge compared to SIA. SIA, being a direct consumer brand, has a more straightforward connection. Opting for a more complex industry allowed us to test our ability to navigate and learn in unfamiliar territory. This involved conducting through research from the ground up. Additionally, some of us had prior experience in M&A cases related to energy, adding relevance and insights that could contribute to this report.

Wei Jie: The choice of Sembcorp over SIA is also influenced by this industry. Currently, ESG (Environmental, social, and corporate governance) is like a hot topic. Opting for Sembcorp allows us to delve deeper into the industry and gain valuable insights as compared to SIA.

Hendrik: It all boils down to the initial reason for joining this competition – our desire to gain experience and learn. That’s why we opted for Sembcorp, seeking exposure in order to broaden our understanding.

How has this entire journey like helped picking up relevant skills?

Wei Jie: The skills that we learned from this competition includes market research skills, your understanding of the industry, financial modelling, and evaluation. These are key skills that are essential in the field of finance. Specifically, focusing on financial modelling, being in charge for it has significantly enhanced my proficiency. Handling more complex company models from scratch has been instrumental in deepening my knowledge and skill set. The challenges faced during the process have been invaluable in grooming me for more intricate financial modeling tasks.

Hendrik: Getting the full picture is crucial and that is what research is all about. While the annual report gives you good insights but it’s essential to consider other sources as well to truly understand what Sembcorp represents. It’s a matter of piecing information together from various channels to paint a complete and accurate picture of the company.

Min Da: When conducting researching on a company or a specific spot, the value extends beyond technical skills; it encompasses essential soft skills crucial for entering finance industry. It only teaches technical aspects of the finance world but hones soft skills such reading through reports, efficiently scanning for vital information and internalizing the acquiring knowledge.

Qi Qian: For me, it boiled down to discipline, especially since I had a full-time internship. Time after work was limited and I often found myself stretched to capacity. Despite the exhaustion, I recognized that importance of fulfilling my responsibilities. No matter how tired I was, meeting deadlines became a non-negotiable commitment. I pushed through and ensured that I delivered what was expected of me.

What do you intend to do with this experience in terms of your aspiration?

Qi Qian: It genuinely made me realize that I have a disliked for equity research reports. This realization is crucial because finance offers a vast spectrum, including deals and various roles. While this particular aspect may not be my preference, this experience taught me valuable research skills applicable to other positions. The overall exposure allowed me to understand my strengths and weaknesses, emphasizing the importance of collaboration in connecting members of different expertise to reach a comprehensive conclusion. The unique process of brainstorming and exchanging of opinions towards a common idea is something I’ve learned and found meaningful.

Wei Jie: From this competition, I’ve discovered areas that pique my interest. Surprisingly, I found that I’m rather intrigued by modeling. It’s something that I would like to explore further and delve into more deeply with various companies. On the other hand, similar to Qi Qian, I found that I’m not particularly fond of equity research reports.

Min Da: Participating this competition has brought to light several areas where I need to enhance my proficiency. Essential skills like financial modelling, report writing and analyzing companies’ portfolio and business model have become evident as fundamental in the finance world. It’s clear to me to master these skills before I can progress toward my aspirations in the finance sector.

Students who are interested to find out more about CFA, you may check out this link: https://www.cfainstitute.org/en/societies/challenge